In recent weeks, Silo, a Bay Area food supply chain startup, has been facing a challenging time. According to TechCrunch sources, the company laid off approximately 30% of its staff, which translates to over two dozen employees. This development comes as a surprise to many in the industry, given Silo’s previous growth and success.

Confirmation from Silo

Silo has confirmed the layoffs in a statement shared with TechCrunch. The company emphasized that the headcount reductions were across the board and not limited to specific departments. The statement also assured that those impacted by the layoffs would receive support, including severance packages and recruitment assistance.

"We recently made the difficult decision to reduce our headcount by almost 30%," Silo stated. "We are committed to supporting those team members impacted and have provided severance packages and recruiting support. At the same time, Silo remains dedicated to serving our customers and the perishables industry at large, and will continue to focus more nimbly on building next-generation supply chain management software solutions."

Background on Silo

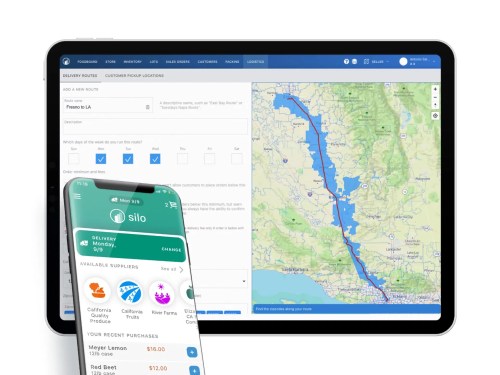

Founded in 2018, Silo’s platform is designed to automate workflows for food and agricultural businesses. The company has since expanded its offerings to include payment products for accounts payable and receivable automation, inventory management, ledger accounting, financing, and more.

However, ahead of the layoffs, an issue arose around a lending product that negatively impacted Silo’s revenue. A company source confirmed that one customer had become delinquent on their loan, prompting Silo’s banking partner to pause the loan product. Despite resolving the problem with the customer and resuming funding, the temporary halt in lending activity made it challenging for the business.

Possible Contributing Factors

It is possible that if Silo had implemented stronger risk management processes, they might not have faced the default. Additionally, the company may be engaging in M&A discussions as a potential resolution to its current situation. This is not the first time Silo has explored M&A opportunities; the company previously discussed potential deals ahead of its Series C funding last year.

Series C Funding and Investment

In summer 2023, Silo raised $32 million in Series C funding. The round included investments from prominent venture capital firms such as Initialized, Haystack, Tribe Capital, KDT, a16z, and others. This influx of capital allowed Silo to pause M&A discussions for a time but has since sparked renewed interest.

Looking Ahead

The future of Silo remains uncertain as the company navigates its current challenges. While layoffs can be a difficult experience for employees and management alike, it may be an opportunity for the business to reassess priorities and refocus on core initiatives.

Timeline of Events

- 2018: Silo founded

- 2023: Series C funding round with $32 million raised

- Recent weeks: Layoffs announced, approximately 30% of staff impacted

- Present day: M&A discussions ongoing

Conclusion

Silo’s recent layoffs and M&A discussions highlight the challenges faced by startups in the Bay Area. As the company continues to navigate its current situation, it will be interesting to see how Silo emerges from this period and what impact these changes have on its operations and growth.

Related Articles

- How Barcelona became an unlikely hub for spyware startups

- China is reportedly open to Elon Musk acquiring TikTok US

Recommended Reads

- Raspberry AI raises $24M from a16z to accelerate fashion design

- Moody’s agrees to acquire Cape Analytics, which develops geospatial AI for insurance providers