Introduction

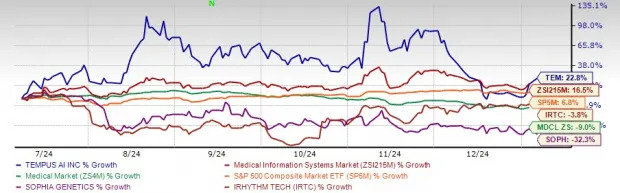

In the rapidly evolving landscape of healthcare technology, Tempus AITEM has emerged as a pioneer in artificial intelligence-based solutions. The company’s impressive performance and growth have caught the attention of investors worldwide, fueling its stock price to skyrocket by 22.8% over the past six months. This outpaces not only the Medical Info Systems industry’s 16.5% rise but also the benchmark’s 6.8% increase.

Outperforming the Market

In comparison with other players in the health infotech field, such as iRhythm Technologies (IRTC) and SOPHiA GENETICS (SOPH), Tempus AITEM has demonstrated exceptional growth. While IRTC declined by 3.8%, and SOPH by a significant 32.3% during the same period, Tempus AI’s stock continues to soar.

Six-Month Share Comparison

Image Source: Zacks Investment Research

Market Appetite for AI in Healthcare

The increasing demand for AI applications in healthcare has catapulted Tempus AITEM into the spotlight as a top contender in this high-growth sector. Analysts attribute the company’s success to its cutting-edge product lines and strategic plans, which position it for long-term success.

Third Quarter Performance: Accelerating Growth

The third quarter of 2024 saw Tempus AI’s Genomics unit growth accelerate by an impressive 23.9% year over year, driven by a 64.4% increase in Data and Services revenues. The Insights or data licensing business also showed significant improvement with an 86.6% year-over-year increase.

Third Quarter Performance Highlights

- Genomics Unit Growth: 23.9% year-over-year acceleration

- Data and Services Revenues: 64.4% year-over-year growth

- Insights or Data Licensing Business: 86.6% year-over-year improvement

Robust 2024 Outlook

Tempus AI continues to expect revenues of approximately $700 million for 2024, representing a significant 32% year-over-year growth. The company also forecasts an adjusted EBITDA of -$105 million, a notable improvement of around $50 million over the previous year.

2024 Revenue and Adjusted EBITDA Outlook

- Revenue: Approximately $700 million

- Adjusted EBITDA: -$105 million

Compelling Acquisition: Ambry Genetics

Tempus AI is optimistic about its plans to acquire Ambry Genetics, a genetic testing player. Under the terms of the agreement, Tempus will pay $375 million in cash and $225 million in shares at closing. Ambry expects to generate more than $300 million in revenues in calendar year 2024 and EBITDA of over $40 million.

Acquisition Highlights

- Purchase Price: $375 million in cash and $225 million in shares

- Ambry’s Revenue and EBITDA Outlook:

- Revenues: More than $300 million in calendar year 2024

- EBITDA: Over $40 million

Improving Healthcare Outcomes with AI

The Centers for Medicare and Medicaid Services (CMS) recent announcement that it will allow reimbursement for assessments of cardiac dysfunction using the Tempus ECG-AF algorithm has opened up new opportunities for Tempus AI. This milestone enables the company to more broadly support clinicians in identifying patients at increased risk of atrial fibrillation/flutter.

Impact of CMS Decision

- Reimbursement for Assessments: Allowed by CMS

- Tempus ECG-AF Algorithm: FDA-authorized medical technology impacted by the new CMS decision

Conclusion

With its robust financial outlook and efforts to improve healthcare outcomes, Tempus AI presents a unique opportunity for investors seeking high returns from the AI and healthcare sectors. Although the company’s valuation may be considered expensive, upward revisions in earnings estimates reinforce TEM’s Zacks Rank #2 (Buy).

Takeaways

- Investment Opportunity: Tempus AI offers a unique chance for investors to capitalize on expanding opportunities in the AI and healthcare sectors.

- Financial Outlook: Robust 2024 revenue and adjusted EBITDA outlook.

- Market Positioning: Well-poised to capitalize on expanding opportunities.

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today!